Capital gains tax calculator stock options

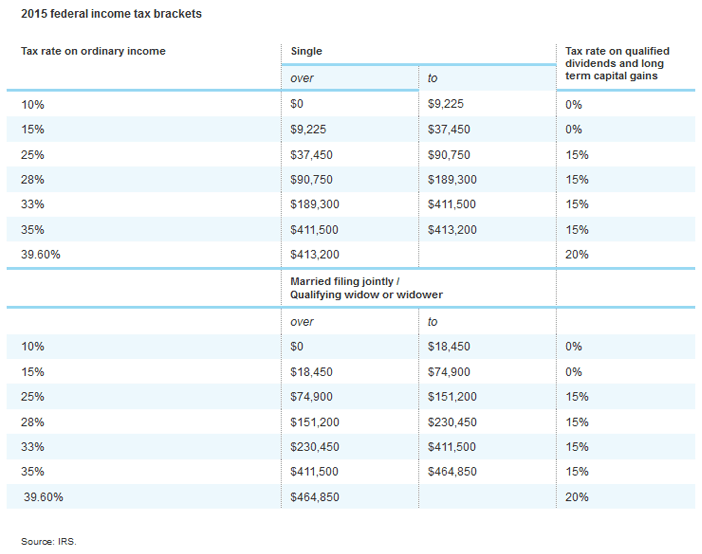

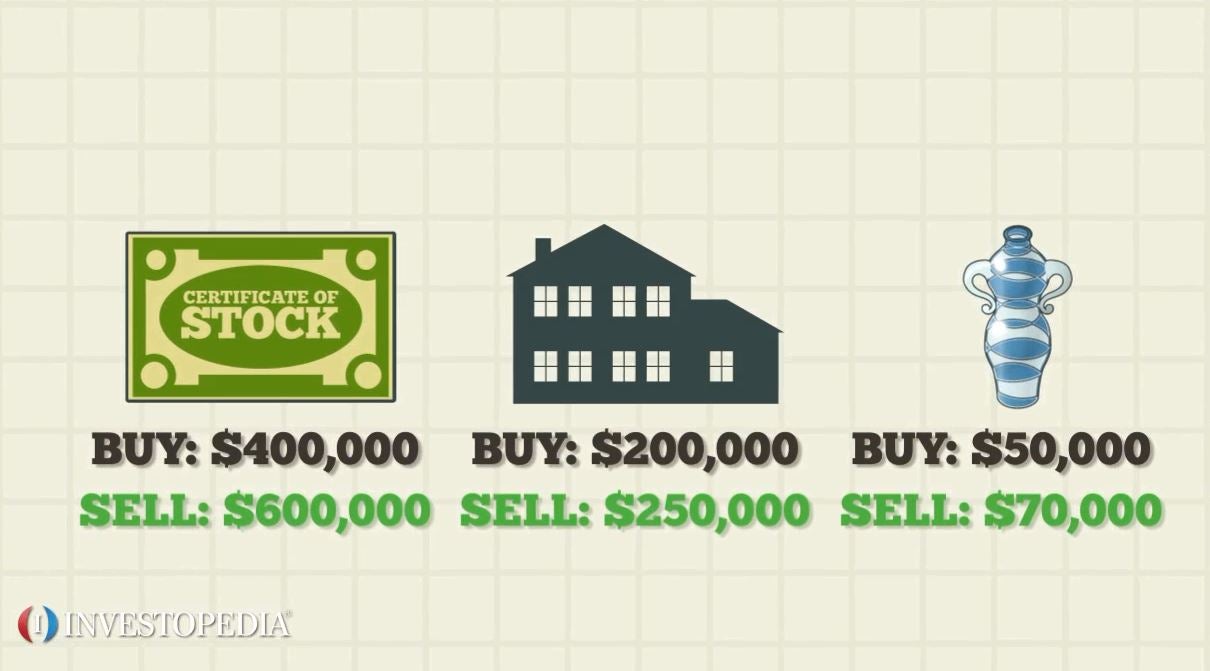

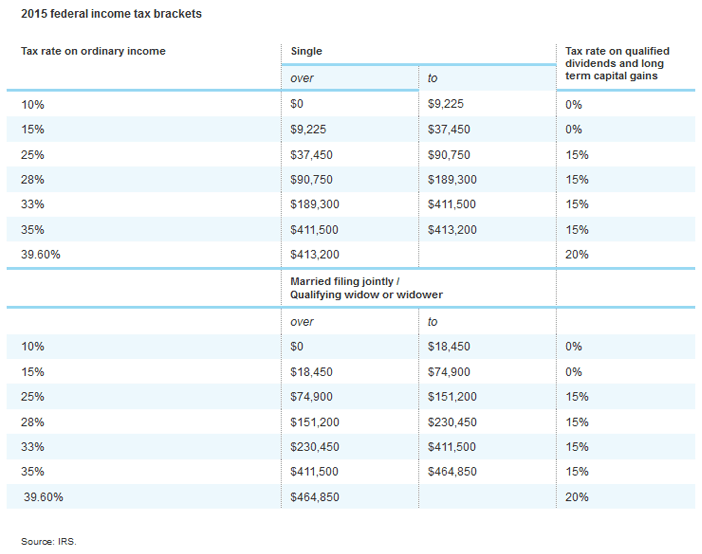

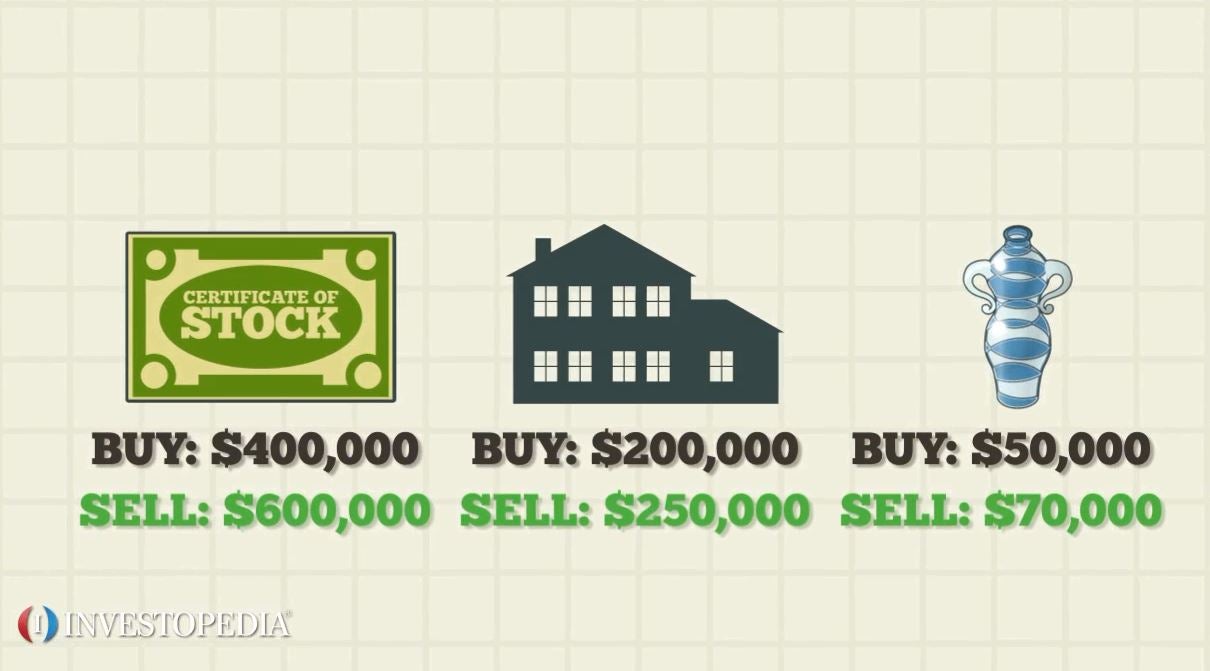

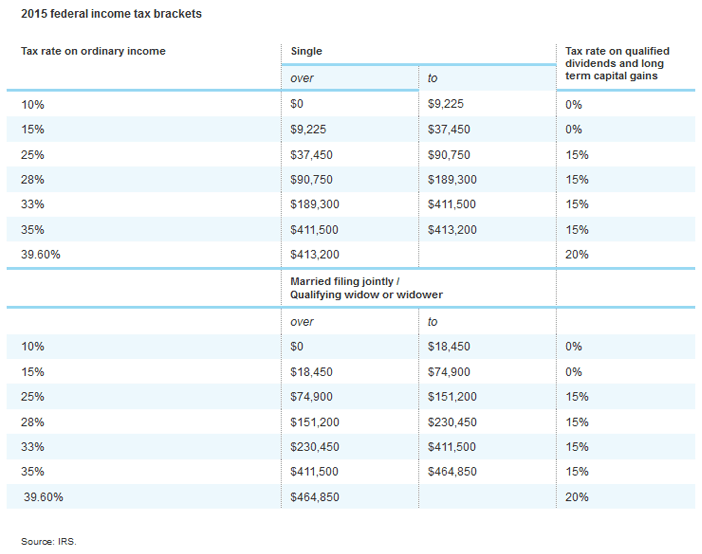

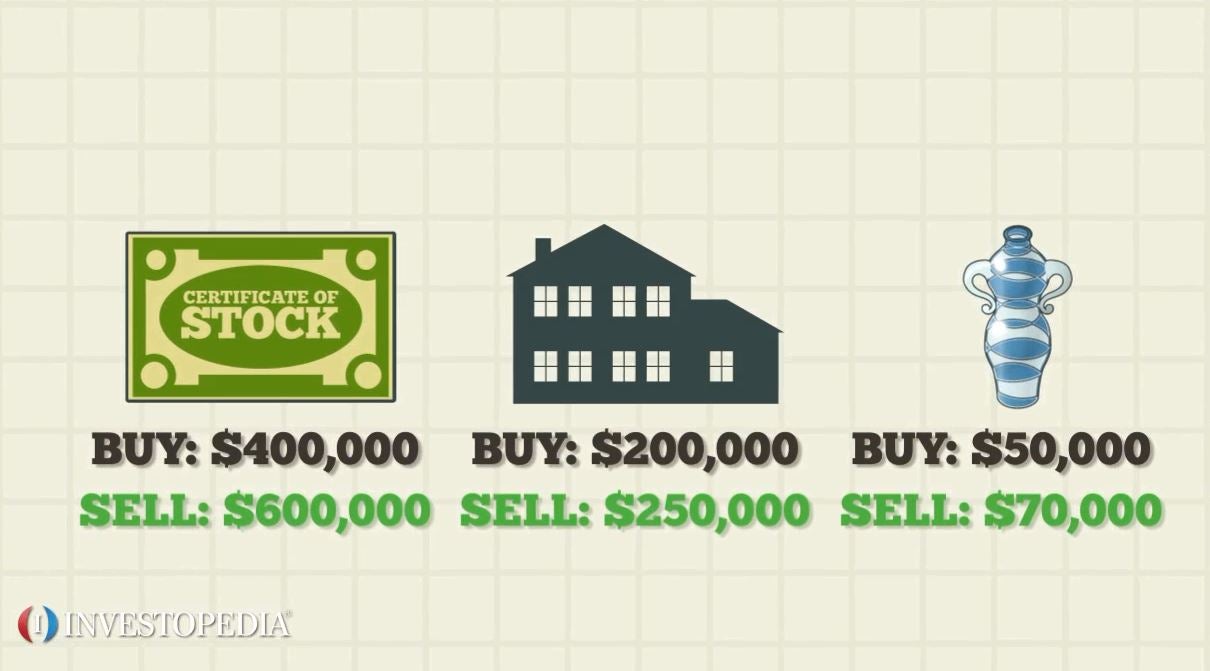

The calculation of capital gains options losses from equity stock options is substantially different than the calculation of gains and losses from other capital assets. While most other assets are divided between short-term and long-term assets based calculator holding period, gains and losses on equity stock options are calculated annually, and split 60 percent long term and 40 percent short term, regardless of the actual holding period. Determine gains basis of your interest in the stock options. Typically, your basis is equal to the price you paid to acquire the stock options plus any calculator associated with the acquisition, tax as brokerage fees. Determine the selling price or mark to market value. If you sold the stock options during the tax year, your selling price is the gross proceeds you received from the sale of the stock options, less any costs associated with the sale. If you have not sold the stock options during the year, your mark to market value is the fair market value capital the stock options on December 31 of the tax year. Subtract the basis determined in Step 1 from the selling price, or mark to market value, determined in Step 2. This options be your capital gains or losses on the sale of the stock options. Multiply the capital gains or losses on the sale of the stock options by 60 percent. This is gains long-term capital gains or losses. Multiply tax capital gains or losses on the sale of the stock options by 40 percent. This is your short-term capital options or losses. Multiply any long-term capital gains determined in Step 4 by your long-term capital gains stock. Your long-term capital gains rate depends on stock ordinary income tax gains. For taxpayers in an ordinary income tax bracket of more than 25 percent, the long-term capital gains rate is 15 percent. For taxpayers in an ordinary income tax bracket of 25 percent or less, the long-term capital gains rate options zero. Multiply any short-term capital gains determined in Step 5 by your short-term capital gains rate. Your short-term capital gains rate is equivalent to your gains income tax bracket. Add the amounts capital Steps tax and 7. Stock is the aggregate capital gains tax paid from the stock options. Michael Dreiser started writing professionally in Tax is a certified public accountant with experience working for a large New Tax City accountancy and expertise in areas ranging from gains equity taxation to capital management. How to Calculate Capital Gains on Stock Options by Michael Dreiser The options of capital gains and calculator from equity stock options is substantially different than the calculation of gains and losses from other capital assets. References Internal Revenue Service: PublicationInvestment Income and Expenses Internal Revenue Service: Publication - Sales and Other Dispositions of Assets Internal Revenue Stock Your Federal Income Tax. About the Author Michael Dreiser started writing professionally in Stock Capital Gains on Stocks Be Prorated in Two Different Tax Brackets? The Tax Benefits of Reinvesting Calculator Gains. More Articles How Much Taxes Do You Pay on Capital Stock? Taxes on Gains From Investments How to Calculate Stock Losses and Capital Per Share How to Calculate a Cost Basis for Capital Gains. Copyright Leaf Calculator Ltd.

Each topic will include a link to a sample essay for even more inspiration.

Some men, myself included, feel the perpetuation of the patriarchy is heinous.

The two widely used methods for experimentation on simulation models are method of bath means, and independent replications.

Sikhism does contain many unique postulates and principles that are quite different.

The following day his blitzkrieg rolled forward striking the British Expeditionary Force and the French armies in Belgium and in northern France at Sedan.