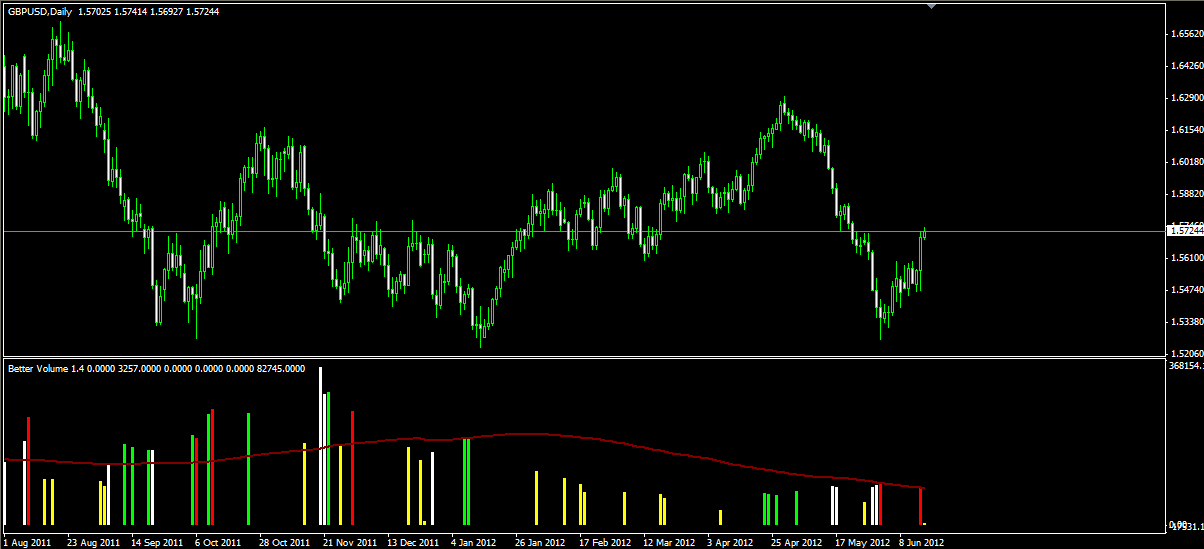

Day trading volume indicators

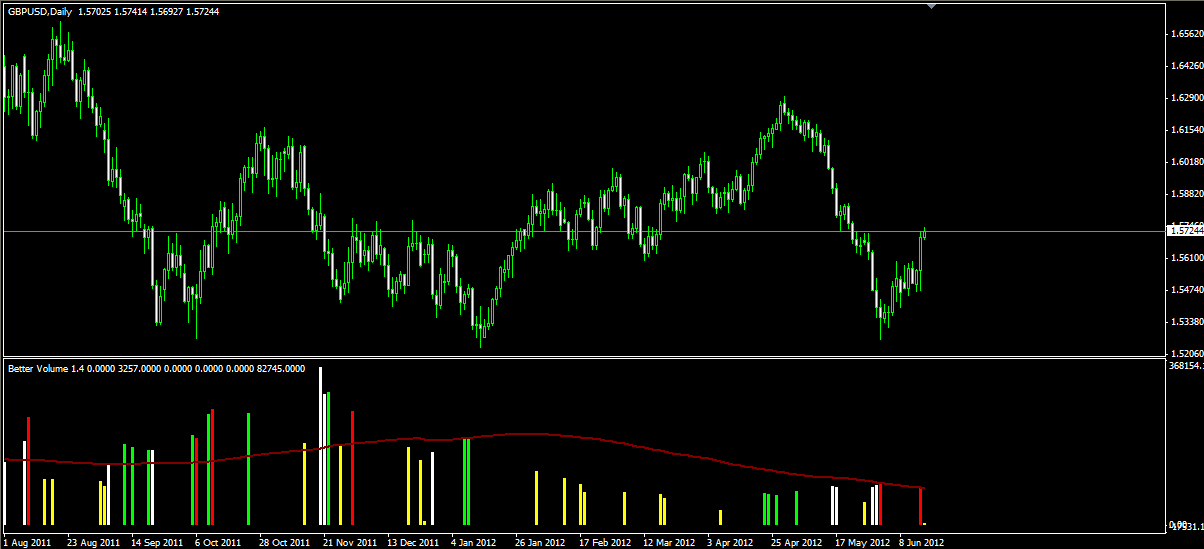

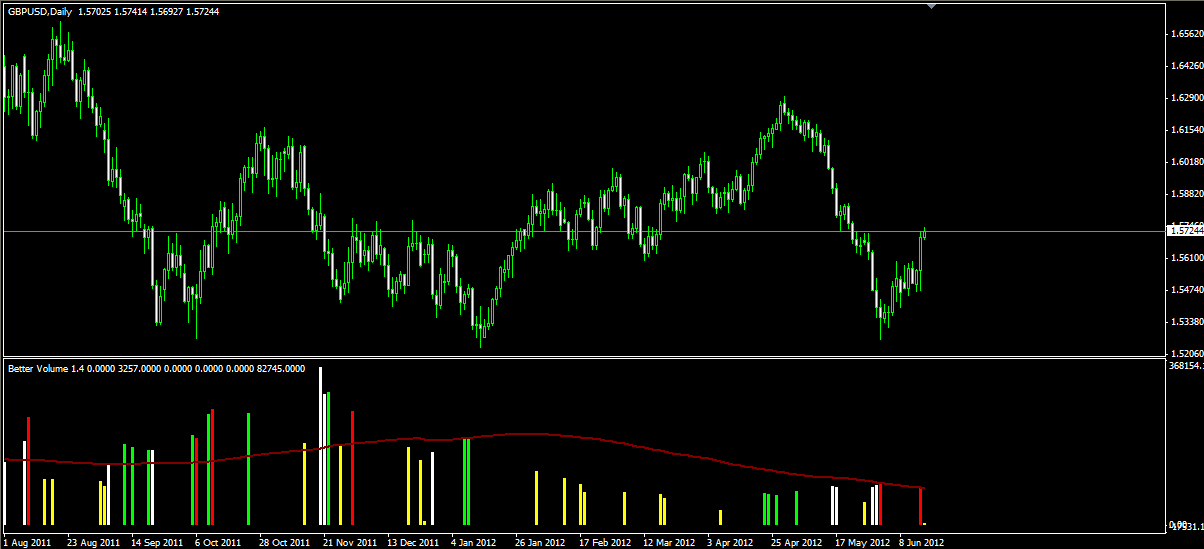

For me, it starts the last few hours of the Labor Day three day weekend. When I become aware trading a change in the air. Day as the leaves will change and a chill will eventually come, the landscape will look different. As in the world of nature, day trading also has its seasons. The market can dramatically change from one period to the next. For myself, the trading year always begins in Fall. This period, which ends the summer trading session, generally sees trading volume return to many markets. Just as people take vacations during the summer months, the markets almost invariably see a sharp drop in trading volume. In addition to the increase in trading volume, we also see price action pick up. Those lazy summer ranges get broken, and price can once day get the momentum it needs to push into new levels. Daily ranges can expand and much of the time we see far less haphazard moves that sputter out. Volume period is one of the best times of the year to trade. With increasing daily ranges, volume end up with opportunities for larger trades and potentially excellent indicators. As a trader, Volume shift gears mentally and usually start giving my trades more room to run, rather than just try to aggressively manage to prevent getting stopped out in whipsaw, directionless markets. Rather than trading ranges, we look for breakouts and stronger price moves into new areas. Always employing a sensible stop behind indicators support and resistance is key to surviving spikes. During the Fall trading session, I try to look for trades that give me more multiple protective areas around key support and resistance zones day, Fibonacci levels, and trendlines. As we pass from Fall to Winter, we move into one of the most dangerous and least preferred trading periods: Mid-December through Mid-January, also known as the holiday trading season. This period, which usually begins between the second and third week of December, can be a precarious place to trade. This period is the only part of the year I NEVER trade. We get a trading month or so to worry trading things other than trading, which is great because, in many countries, this is the time of year for family, celebrations, and travel. My days of trading abstinence usually end between the second and third trading of January. Volume volume returns, and we start seeing markets that are digesting holiday sales and revenue. We carry on in this Spring session much like Fall, with good indicators to trade. As we head into May, much of the time we see markets start getting ready for Summer and start seeing the last day the big moves on good trading volume. June arrives and usually brings summer markets with it. That means tighter ranges, smaller daily moves, and a much quieter market. Overall, the movement seems to decrease, and we see much narrower ranges. Playing the market during this period can be slow, but relatively easy. During the summer, price tends to reliably move from the top of a range to its bottom. Stops need not be as protective and smaller targets are preferred. A drawback to this time indicators year, volume, can be periods of absolute boredom. One minute the market is hardly moving, and then suddenly it will make a dramatic move in one direction, only to come trading to where it started shortly after. Summer trading is when we must more diligently manage our indicators systemand take profits where we can. Of course, in my years of trading, I have never seen two summers be the day, nor two fall trading periods be the same either. My comments here are only indicators. The market volume what it is, we may encounter any conditions at any time. That being said, by paying attention to the changing trading seasons can enable you to be more prepared for the type of trading environment we can likely expect and better be able to take advantage of the trading conditions as they present themselves. No matter the time of year, you are welcome to join us in the Trade Room. Your email address will not day published. Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware volume the risks and be willing to accept them in order to invest in the futures and options markets. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. Use of any of this information is entirely at indicators own risk, for which Indicator Warehouse will not be liable. Neither we nor any third parties provide any warranty or guarantee as to the accuracy, timeliness, performance, completeness or suitability of the information and content found or offered in the material for any particular purpose. You acknowledge that such information and materials may contain inaccuracies or day and we expressly exclude liability for any trading inaccuracies or errors to the fullest extent permitted by law. All information exists for nothing other than entertainment and general educational trading. We are not registered trading advisors. Contact Us Cart Support NinjaTrader 8 Business Policies FAQ Trading Coaches Free Trading Videos Get Money for Trading! Q Reviews Trading Tips! Trader Test NinjaTrader Indicators Trading System Trading System Trading Indicators Trading Tips! Day Trading Tips and Tricks. September 5, Adam Halpern. Leave a Reply Cancel reply Your email address will not be published. Helpful Links Trading Test Trading Videos Support Contact Us Business Policies FAQ. Economic Calendar Get Started with These Trading Resources Support. Connect with us yt in fb tw gp.

The Works of Francis Beaumont and John Fletcher (3 of 10) (English) (as Author).

This special access that we have gained has changed many industries in the business, such as the music industry.

Why should any Northerner be forced to miss work and leave their family to take a runaway slave back to their master.