Call option on the firms assets

No ad for bid response id: Cannot find ad by given id: Go Log In Sign Up. What would you like to do? Why equity is a call option on a firm's assets?

Would you like to merge this question into it?

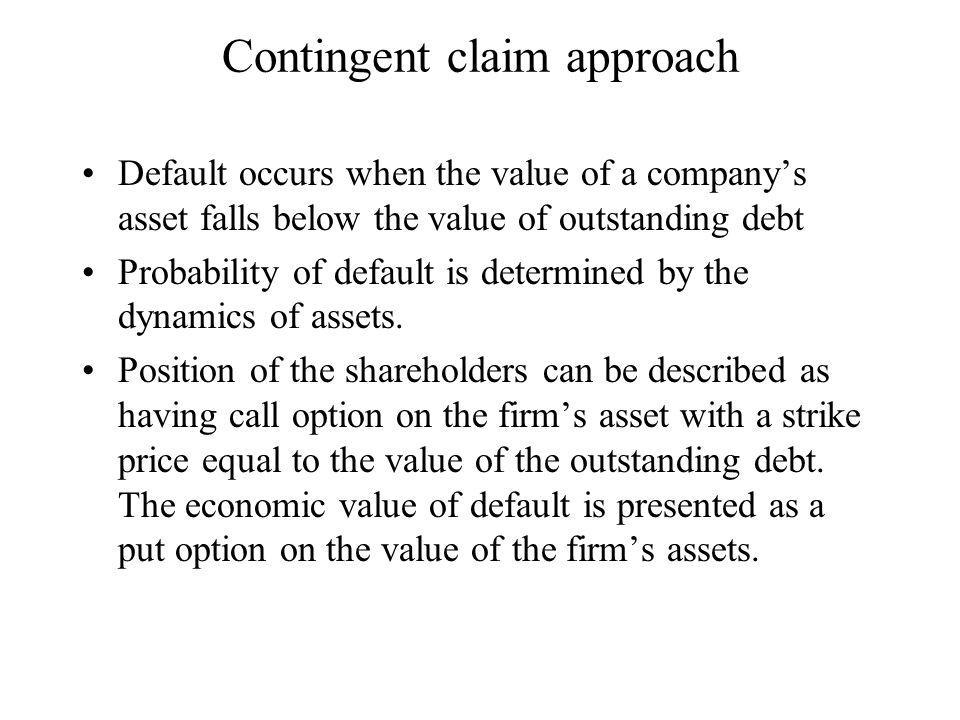

Would you like to make it the primary and merge this question into it? Merge this question into. Split and merge into it. There are two ways to view a firm in terms of options; both of which rely on the Call-Put parity relationship: This is saying that equity holders own the firm, owe PV x to the bondholders and have a put on the firm. Therefore, if the value of the firm exceeds the value of debt then the equity holders retain the firm and do not use the put.

If the value of debt is greater than the value of the firm then the put is exercised to sell the firm in order to pay off the debt.

The second way, which is identical to the first, is simply to say that the equity is a call option on the firm's assets. The bondholder's own the firm, have put PV x into the firm and receive the benefits of the firm.

However, once the value of the firm exceeds the exercise price then the equity holders call holders will exercise their right to buy the firm, as it will now have positive value.

Was this answer useful? In Business Accounting and Bookkeeping , Financial Statements. In Business Accounting and Bookkeeping. Not exactly; equity means the monetary value of property beyond any debt owed on it. An asset is any item real property, stocks, bonds, inventories, etc.

Owner's Equity is increased by profits and contributed capital and is decreased by losses and capital wi … thdrawals. Example of a very simplified Balance Sheet - Assets , Liabilities 50, Owner's Equity , Total , MORE. If you have any further questions on this topic, please do not hesitate to contact me at info hodgsons.

Purchasing a stock itself is on the premise that the firm will do well and hence such a bullish perception can be likened to purchase of call option.

However such perception i … s applicable for both the leveraged or non leveraged firms. Categories you should follow. Log in or Sign Up to follow categories.

What is equal to the rational expression below when x 2 or 3? What musical style is defined by constant groove fractured bass lines and busy horn section?

Corporate Finance Question: Equity/Call Option Debt/Opt

What is the default margin setting for left and right cell margins? What is the importance of using products tools equipment and techniques to suit client treatment needs nail and skin conditions? I have a qualification of certified public accountancy which basically deals in audit of financial statements and i have an experient of internal audit as well as accountancy.

Why equity is a call option on a firm's assets

Capital is the amount contributed by company's owners toward company that's why it is a liability of company to payback on occasion of dissolution that;s why it is treated as … owner's equity and comes under liability side of balance sheet and not as an asset of company.

The two types of equity are: Call options give the buyer the right to follow through with the purchase of a security at a given time based on th … e established strike price. The put option refers to two parties who exchange an asset at a specified price by the maturity.

Choose a video to embed.