Multi timeframe analysis forex

Multiple TimeFrame analysis MTF is considered to be one of the most robust technical analysis models, where in, the trader analyses at least two or more different time frames in order to draw up a trading plan.

An Explanation of How to Use Multiple Time Frame Analysis

For the average trader, multiple timeframe analysis could seem to be a bit complicated due to the various timeframes involved. But with a disciplined approach a trader could very well incorporate multiple timeframe analysis with ease.

The easiest way to avoid such traps is to have a firm plan in mind before looking to multiple timeframes to generate more robust trading ideas. The first question that comes to mind when talking about multiple timeframe analysis is its effectiveness and whether this approach offers any value to the trader, or gives an edge.

The simple answer is Yes; but only when applied correctly. The main purpose of multiple timeframe analysis is for the trader to time their entries and exits.

The importance of multiple time frame analysis could best be illustrated with an example. You spot a bullish engulfing pattern on a weekly chart.

Multiple Time Frame Analysis Thorough, Powerful - Forexearlywarning

This simply tells you that the next and a few candles could close bullish. But at which price would you enter long?

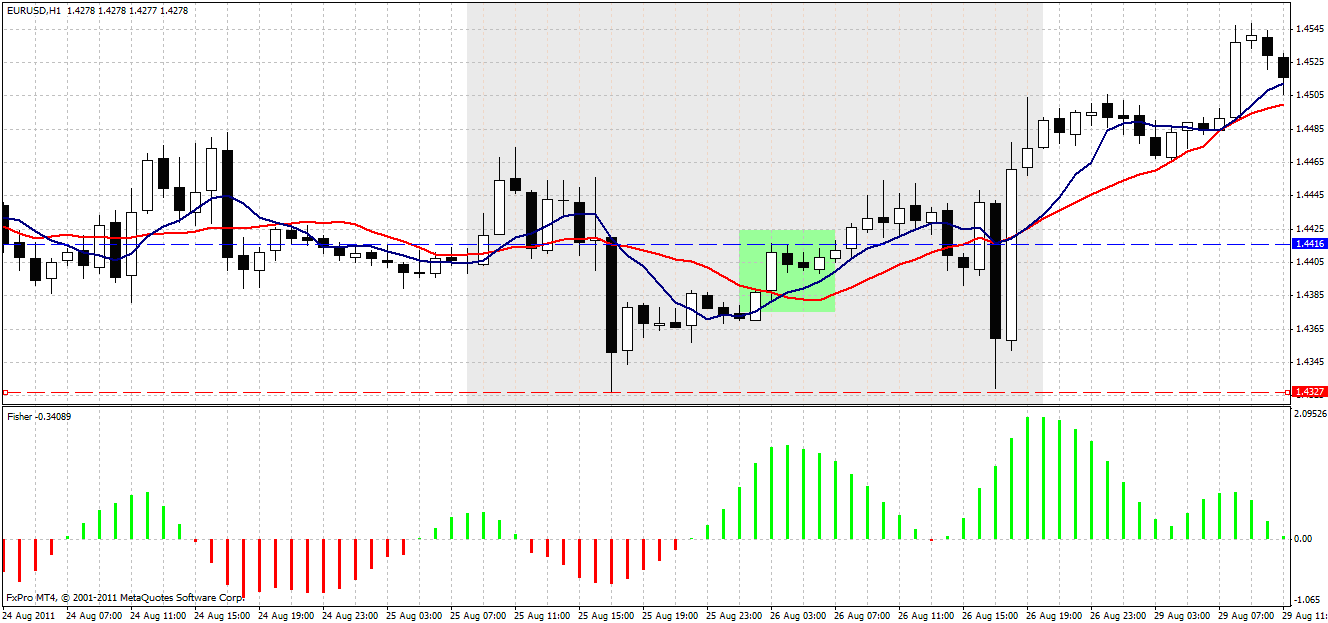

Sam Seiden: Multiple Time Frame AnalysisDo you simply enter long at the open of the next weekly candle and risk the retracement that generally applies? With multiple time frame analysis in forex your entry can be timed such that you minimize your risk while maximizing your profits. The chart below illustrates one such example of how multiple time frame analysis helps.

In this example we take a look at the GBPUSD currency and apply weekly and H4 multiple time frame analysis to find a better level of entry and this minimize risks.

Besides the above example, traders can use multiple time frame analysis in different ways, some of which are summarize below: One of the simples and common uses of MTF is based on indicators.

Example, if the Stochastics indicator gives a buy signal on the Daily chart, then the trader would shift to H1 chart and wait for a buy signal to be triggered which helps in timing. Using moving averages under MTF is also a popular method.

Unlocking the Secrets of Multiple Time Frame Analysis

When traders consider multiple time frame analysis, they should also take into account the time it takes for holding the trades. The table below should give a quick summary for traders: Improve Your Trading Skills - Don't miss our new posts! Trading Forex, Binary Options - high level of risk.

Multiple Time Frame Analysis Thorough, Powerful - Forexearlywarning

Please remember these are volatile instruments and there is a high risk of losing your initial investment on each individual transaction. Home Forex Brokers Binary Options Brokers Trading Software Forex VPS Signals Analysis Other Tools Forex Education Forex Strategies BinaryOptions Education Binary Options Bonuses Binary Options Strategies Articles Humor ProfitF Write For Us Advertising Contacts.

Bio Latest Posts Subscribe to Updates. An Arabic Forex broker from Egypt http: Latest posts by MTrading see all.

Channel Trading in Forex. Forex Brokers Reviews Binary Options Brokers Reviews Trading Software Forex VPS Trading Signals. Newest Forex EA, Systems. UltimateProfitSolution Forex Libra Code Binary signals indicator FXOxygen EA FastFXProfit System.