Tableau de correlation forex

The following tables represents the correlation between the various parities of the foreign exchange market. The correlation coefficient highlights the similarity of the movements between two parities. The correlation of currencies allows for better evaluation of the risk of a combination of positions.

Correlation measures the relationship existing between two currency pairs. For example, it enables us to know whether two currency pairs are going to move in a similar way or not.

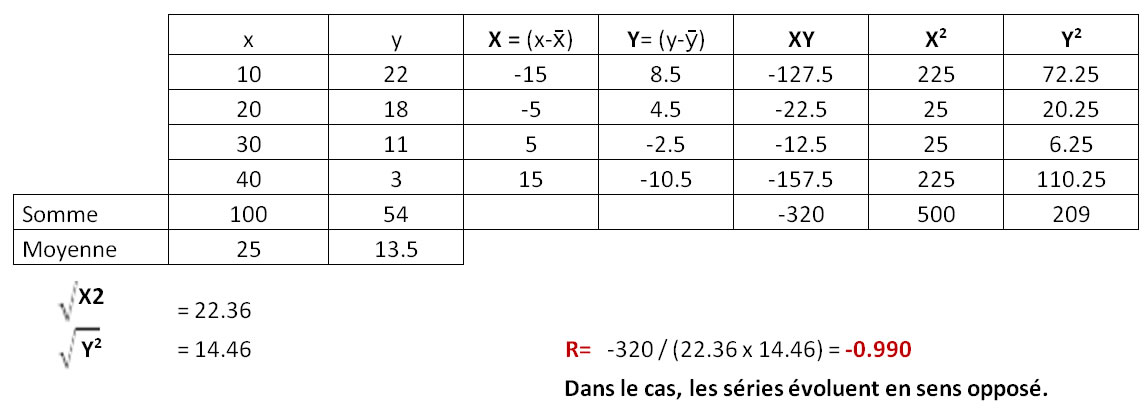

Two correlated currencies will have a coefficient close to if they move in the same direction and of if they move in opposite directions. A correlation close to 0 shows that the movements in the two currency pairs are not related.

Corrélations inter-devises et trading forex

The calculation of the correlation on this site uses the standard formula known as the "Pearson coefficient of correlation". The length of the series is given by the "Num Period" field.

For further information about the calculation, you can visit the Wikipedia page: It may be important to know whether the open positions in a portfolio are correlated.

If you have open trades in three currency pairs which are strongly correlated for example EURUSD, USDCHF and USDNOK , you must anticipate the fact that if one of the positions reaches its stop-loss, then the other two are very likely to also be loss-making positions.

In this case, it is important to adjust the size of the positions in order to avoid a serious loss.

A modification of the correlation, principally over the long-term, may demonstrate that the market is undergoing a change. About - Contact - Legal.

Forex Trading tools Forex Correlation. If the correlation is high above 80 and positive then the currencies move in the same way.

Profession : marchand de biens - les dessous des cartes - Objectif Eco, anticiper pour s'enrichir

If the correlation is high above 80 and negative then the currencies move in the opposite way. If the correlation is low below 60 then the currencies don't move in the same way. AUDCAD AUDCHF AUDHKD AUDJPY AUDNZD AUDSGD AUDUSD CADCHF CADHKD CADJPY CADSGD CHFHKD CHFJPY CHFZAR EURAUD EURCAD EURCHF EURCZK EURDKK EURGBP EURHKD EURHUF EURJPY EURNOK EURNZD EURPLN EURSEK EURSGD EURTRY EURUSD EURZAR GBPAUD GBPCAD GBPCHF GBPHKD GBPJPY GBPNZD GBPPLN GBPSGD GBPUSD GBPZAR HKDJPY NZDCAD NZDCHF NZDHKD NZDJPY NZDSGD NZDUSD SGDCHF SGDHKD SGDJPY TRYJPY USDCAD USDCHF USDCNH USDCZK USDDKK USDHKD USDHUF USDINR USDJPY USDMXN USDNOK USDPLN USDSAR USDSEK USDSGD USDTHB USDTRY USDZAR ZARJPY Refresh Download CSV.

EURUSD GBPUSD USDCHF USDJPY EURJPY USDCAD AUDUSD EURAUD USDZAR USDHKD EURUSD How is it calculated? Management of risks It may be important to know whether the open positions in a portfolio are correlated. Modification of the market A modification of the correlation, principally over the long-term, may demonstrate that the market is undergoing a change.