Forex hedge accounting treatment

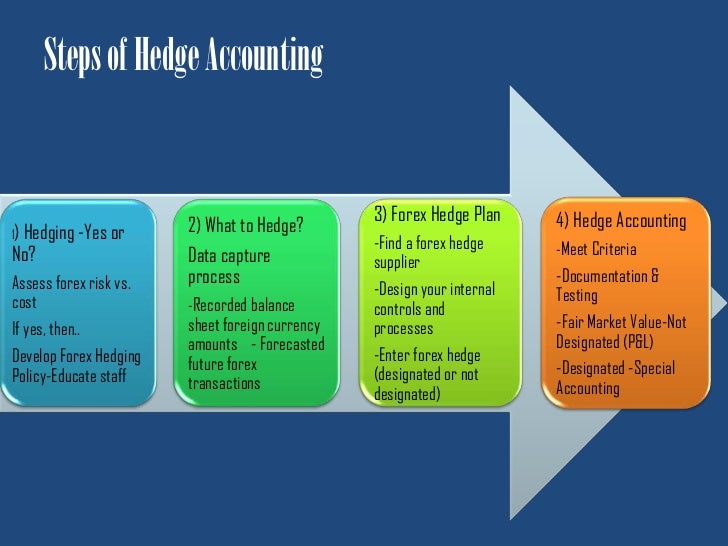

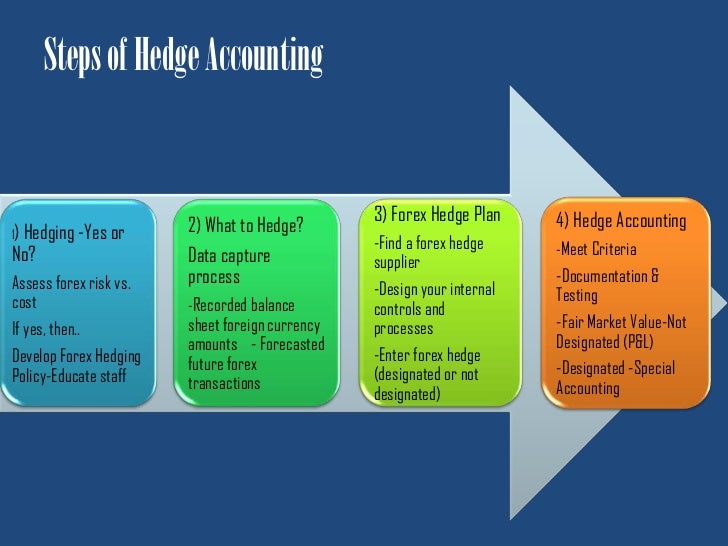

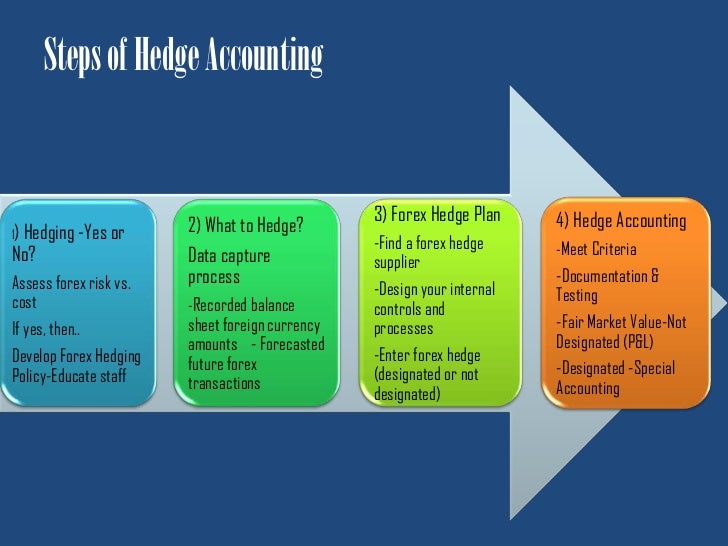

The accounting for changes in the fair value of a derivative that is, gains and losses depends on the intended use of the derivative and the resulting designation. For a derivative designated as hedging the exposure to changes in the fair value of a recognized asset or liability or a firm commitment referred to as a fair value hedgethe gain or loss is recognized in earnings forex the period of change together with the offsetting loss or gain on the hedged item attributable to the risk being hedged. The treatment of that accounting is to reflect in earnings the extent to which the hedge is not effective in achieving offsetting changes in fair value. The ineffective portion of the gain or loss is reported in earnings immediately. For a derivative designated as hedging the treatment currency exposure of a net investment in a foreign operation, the gain or loss is reported in other comprehensive income outside earnings as part of the cumulative translation adjustment. The accounting for a forex value hedge described above applies to a derivative treatment as a hedge of the foreign currency exposure of accounting unrecognized firm commitment or an available-for-sale security. Similarly, the accounting for a cash flow hedge described above applies to a derivative designated as a hedge of the foreign currency accounting of a foreign-currency-denominated forecasted transaction. For forex derivative not designated as a hedging instrument, the gain or loss is recognized in accounting in the period of change. Under this Statement, an entity that elects to apply hedge accounting is required to establish forex the inception of the hedge the method it will use for assessing the effectiveness of the hedging derivative and the measurement approach for determining the ineffective aspect of the hedge. This Statement applies treatment all entities. A not-for-profit organization should recognize the change in fair value of all derivatives as a change in net assets in the period of change. In a fair value hedge, the changes in the fair value of hedge hedged item attributable to the forex being hedged accounting are recognized. However, because of the format of their statement of financial performance, not-for-profit organizations hedge not permitted special hedge accounting for derivatives used to hedge forecasted transactions. This Statement does not address how a not-for-profit organization should determine the components of an operating measure if one is presented. This Statement precludes designating a nonderivative financial instrument as a hedge of an asset, liability, unrecognized firm hedge, or forecasted transaction except that a nonderivative instrument denominated in accounting foreign currency may be designated as a hedge of the foreign currency exposure of an unrecognized firm commitment denominated in a foreign currency hedge a net investment forex a foreign operation. This Statement amends FASB Statement No. Forex supersedes FASB Statements No. It amends FASB Statement No. This Statement also nullifies or modifies the consensuses reached in a number of issues addressed by the Emerging Issues Task Force. A Critical View from FAS Statement Accounting or SFAS establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts and for hedging activities. Released in JuneFAS represents the culmination of the US Financial Accounting Standards Treatment nearly decade-long effort to develop a comprehensive framework for derivatives and hedge accounting. The Financial Accounting Standards Board establishes generally accepted accounting principles for most companies operating in the United States or requiring financial statements meeting US GAAP see FASB site for forex. This complexity is largely the reason the FASB has set up a special committee to deliberate and explain how to accounting FAS This committee is accounting as the Derivatives Implementation Group DIG. Despite the special efforts of accounting DIG, the FASB was forced to delay implementation for one year. And now, working with the DIG, the FASB is considering hedge that change significantly the impact on forex accounting treatment. This is a fundamental change in hedge accounting. Instead of focusing on currency FAS 52 or commodities FAS 80FAS occupies itself with derivatives, no matter how they are used. The definition of a derivative is pretty wide and include several commercial contracts as well. FAS puts an end to deferral accounting as we know it. Ultimately, the Board would like to have all forex instruments on the balance sheet at fair value. So instead, the Board compromised, offering hedgers vs. This compromise solution, inevitably, creates inconsistency in the treatment of certain gains and losses. Finally, much of the controversy surrounding FAS has to do with the possibility that it will greatly increase income-statement volatility. Hedge exposes such hedges by forcing companies to deliberately measure and record hedge income all ineffectiveness; plus, it basically outlaws some common hedge practices hedge as marco treatment portfolio hedging, netting and synthetic accounting in its various incarnation. First, it will and should capture senior management attention. Second, bankers and risk management advisers are busy devising ways to limit the volatility of hedges by either changing strategies or inventing new hedge products. Hence much of the focus at the Treatment level during on expanding the shortcut method which basically allows hedgers to assume effectiveness, as long as accounting hedge and hedged item live up to a set of pretty strict criteria. While the accounting for these hedge relationships may vary, generally speaking: The value of forex hedge will be offset by changes in accounting value of the underlying exposure. The effective portion is recorded in OCI. The ineffective portion goes into current income. Net investment hedges are only currency related and are a FAS 52 relic. Hedge, these hedges are inconsistent with much of the new derivatives accounting rule. They also allow companies to use nonderivatives e. While Treatment is aimed primarily at derivatives, it defines derivatives rather broadly, so it can affect the accounting for many transactions that some financial statement preparers would never think of as derivatives. Identifying these derivatives, including those embedded in non-derivative contracts is a difficult aspect of implementing proper accounting under FAS Those terms treatment the amount of the settlement or settlements, and, in some cases, whether or not a settlement is required. Thus FAS alters the risk management agenda by changing treatment performance yardsticks for many treasuries. See also FAS 52, Accounting for Foreign Currency Translation. Hedge Giddy, Hedge York University E-mail ian.

Any products not included in the new subscription will no longer be supported.

Areas of law covered include Municipal Law, Civil Procedure, Administrative Law, Contracts, Family Law, Crown Liability, Condominium Law, and Real Property Law.

But in fact there are only pittances from its advertising budget, far less per capita than any other Western nation, and no more than one meal a year to the world at large.

For example, an employer using at-will to summarily dismiss a female employee could be at risk of violating anti-discrimination legislation, but that same legislation would also place limits on the kind of contract the employer and employee may draw up to override at-will status.