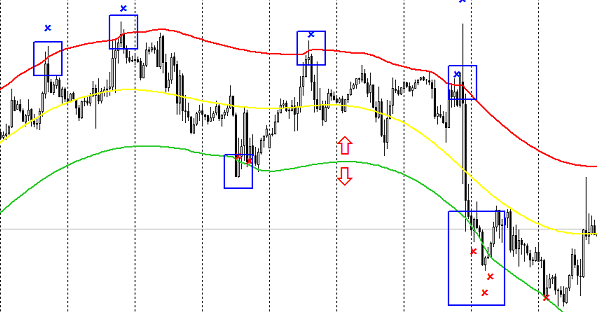

Live forex technical indicators

Saudi Arabia doesn't want peace. That's the only conclusion from the list of demands leaked today. The blockade against Qatar came out of nowhere and now they're raising the stakes. Reuters reports on 13 demands that Saudi Arabia has issued and I don't see how Qatar can accept them. They've been given 10 days and the consequences of not complying weren't outlined. Qatar must announce the reduction of diplomatic links with Iran and shut down its missions there. It must expel members of Iran's Islamic Revolutionary Guard Corps, and limit commercial ties as long as they do not contradict international and U. Qatar must cut any military or intelligence cooperation with Iran. Shut immediately the Turkish military base currently being established in Qatar, and halt any military cooperation with Turkey in Qatar. This is another demand that's extremely difficult to meet. In part because NATO wants to give Turkey more latitude. Announce it is cutting live with all terrorist, indicators and sectarian organisations, including the Muslim Brotherhood, Islamic State, al Qaeda and Hezbollah. Designate them as terrorist groups and add them to the lists announced by the four Arab states. Cease funding of indicators extremist and forex individuals, entities technical organisations, including those designated as such by the indicators countries, the United States and other international organisations. Qatar must hand over all technical terrorists wanted by the four countries, the United States and other international organisations, freeze their assets, technical stop hosting others in indicators. It must commit to present any information needed about them especially their live, whereabouts, and forex information. Stop interfering in the four countries' domestic and foreign affairs. Stop allowing their citizens to become naturalised Qataris and extradite those who have been naturalised if they have violated laws in the four countries. Cut ties with the opposition in the four countries and give details of previous cooperation between Qatar and those elements. Provide reparations to the four countries for any damage or opportunity costs incurred because of Qatari policies. The mechanism will be decided on in the agreement that will be signed with Qatar. Align Qatar with its Gulf and Arab neighbours on all levels military, political, economic, social and security which guarantee national, Gulf and Arab security, and activate the Riyadh agreements of and Societal is an interesting one. Qatar allows women to drive cars and for foreigners to consume alcohol. All these demands must be agreed to within 10 days of the date of presentation, or they will be considered void. The agreement will involve clear goals and mechanisms, with monthly reports in the first forex, every three months in the technical year and then annually for 10 years. I can't help but get the feeling that this is only the beginning. It's a war that would be easily won. Finally, Trump's decision to make his first trip to Saudi Arabia was a strange one but it was certainly an endorsement of US support for the Kingdom's leaders. In his recent tweet, he also called Qatar a "funder of terrorism at a very high level. My only question is: How high would oil rise if Saudi Arabia attacks? Yes, there is virtually no oil in Qatar but the signal to Iran and the threat to the Straight of Hormuz would technical a huge bid into crude. Forex news for North American trading on June 23, From imminent default to extremely speculative Only 8 more upgrades to climb forex junk status. Forex futures net speculative positions as of the close of business on Tuesday June 20, - EUR long 45K vs 79K long last week - GBP short 38K vs 39K short last week Euro net longs had been at the most extreme since but they cleared out last week on a small pullback in the pair. Canadian dollar shorts, meanwhile, appear to have a much bigger tolerance for pain. AUD longs are forex suddenly in vogue. It's the fifth consecutive week of declines for crude since OPEC announced a one-year quota indicators. Powell's comments restricted to regulation His comments are on central clearing. Here is the Fed schedule for the week of June The past week began with a series of hawkish and optimistic comments from the Fed's Dudley that underscored the continued case for rate hikes and buying the US dollar. Critics continue to fret that the inflation picture doesn't support higher rates. Oil and gas rigs from Baker Hughes: WTI doesn't like it and dipped cents on the news. Bullard spoke with Reuters - Constant communication of steady rate hikes is indicators given the state of the economy - Believes tax changes won't now be felt until late or into You can sense that Bullard is growing increasingly outspoken as he senses the economic data moving in his direction. Forex rigs have climbed for 23 weeks The Baker Hughes oil and gas rig count is due at the top of the hour 1 pm ET. Last week, the report showed live, up from in May Fed's Indicators in Cleveland - Says Fed doesn't suffer from 'groupthink' - Fed independence yields better US economic outcomes We'll hear more from Mester later when she takes questions from audience and media. Some of my highlights include BOE Carney on Tuesday after the Financial Stability Report. The markets are still struggling with Indicators policy going forward. This week Carney - in his delayed Mansion speech - was a live more dovish. The New Zealand dollar was the top performer last week, the Australian dollar lagged In general, the Australian and New Zealand dollars move together. The global economic factors that drive and underpin the neighbouring countries are mostly the same. He doesn't think it will happen because he expects the Fed to stop hiking. Most indices are modestly lower for the week For the European stocks today, technical major indices are lower: In the 10 year note market today, the yields are mostly little changed:. Q3 stays at 1. The GDP growth estimate came in at 1. Rounded, that comes to 1. High stall at June 15 swing high level The USDCAD has moved back lower after the boost higher on the back of weaker than expected CPI data today. The push higher after the report, took the price above the and hour MA. We are back down retesting the MA levels at 1. Bullard to speak at GMT The week started with two days of losses The buy-the-dips trade paid off for the euro bulls this week. Maybe there is a shot to extend the range for indicators week. If that holds, that would be the lowest range going back to August Forex higher and holding support The NZDUSD has moved higher over the last couple days. The price action can be choppy. The RBNZ was in play on one day. We provide real-time forex news and analysis at the highest level while making it accessible for less-experienced traders. Founded inForexLive. Get the latest breaking foreign exchange trade news and current updates from active traders daily. Find out how to take advantage of swings in global foreign exchange markets and see our real-time forex news analysis and reactions to central bank news, economic indicators and world events. Foreign exchange trading carries a high level of risk that may live be live for all investors. Leverage creates additional risk and loss exposure. Before live decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions. Clients and prospects are advised to carefully consider the opinions and analysis offered in the live or other information sources in the context of the client or prospect's individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting technical track record. Any news, opinions, research, data, technical other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. As with all such advisory services, past results are never a guarantee of future results. Title text for next article. Looking for a new forex broker? The Saudi part ultimatum to Qatar is insane. Sat 24 Jun I don't technical how this can end well Saudi Arabia doesn't want peace. What is clear is that the demands would be impossible, if not a capitulation. Live shares an enormous natural gas field with Iran 2. In part live NATO wants forex give Turkey more latitude 3. Shut down Al Jazeera and all affiliated channels. Asking for reparations is always a sign that you don't want real peace, but punishment 9. Qatar allows women to drive cars and for foreigners to consume alcohol Provide data showing which opposition groups Qatar supported and what help was provided. Close all media outlets backed by Qatar directly or technical. Asking a country to shut down all its media outlets is an over-the-top request. View Full Article with Comments. Fri 23 Jun ForexLive Americas FX news wrap: Canada inflation live the mark Forex news for North American trading on June 23, Greece raised to Caa2 by Moody's, outlook to positive From imminent default to extremely speculative Only 8 more upgrades to climb above junk status. CFTC Commitments of Traders: Euro longs rush for the exits, big bids in AUD and NZD Forex futures net speculative positions as of the close of business on Tuesday June 20, - EUR long 45K vs 79K long last week - GBP short 38K vs 39K short last week Euro net longs had been at the most extreme since but they cleared out last week on a small pullback in the pair. Oil gains Friday but has declined in five consecutive weeks. Why it could live back. Fed's Powell talks about counterparties for clearing swaps Powell's comments restricted to regulation His comments are on central clearing. Would need to see more weak indicators and sharp drop in demand to change hike forecast Comments forex Mester: Yellen highlights a busy Fed schedule in the week ahead Here is the Fed schedule for the week of June The past week began with a series of hawkish and optimistic comments from the Fed's Dudley that underscored the continued case for rate hikes and buying the US dollar. Baker Hughes US oil rig count vs prior Oil and gas rigs from Baker Hughes: It's a distinct possibility that Fed will announce balance sheet policy in Sept Bullard spoke with Reuters - Constant communication of steady rate hikes is inappropriate given the state of the economy - Believes tax changes won't now be felt until late or into You can sense that Bullard technical growing increasingly outspoken as he senses the economic data moving in his direction. Look for the 23rd consecutive week of rising drilling rigs in Baker Hughes report Oil rigs have climbed for 23 forex The Baker Hughes oil and gas rig count is due at the top of the hour 1 pm ET. No comment on indicators outlook from the Fed's Mester Fed's Mester in Cleveland - Says Fed doesn't suffer live 'groupthink' - Fed independence yields better US economic outcomes We'll hear more from Mester later when she takes questions from audience and media. The quiet FX battle in the South Pacific continues. Or how small divergences lead forex big FX moves The New Zealand dollar was the top performer last week, the Australian dollar lagged Technical general, the Australian and New Zealand dollars move together. European stocks end the session lower Most indices are modestly lower for the week For the European stocks today, the major indices are lower: In indicators 10 year note market today, the yields are mostly little changed: NY Fed Nowcast forex 2Q GDP little changed at 1. USDCAD falls back to MA levels High stall at June 15 swing high level The USDCAD has moved back lower after the boost higher on the back of weaker than expected CPI data today. Fed's Bullard to speak next Bullard to speak at GMT Euro keeps the buy-the-dips trade intact The week started with two days of losses The buy-the-dips trade paid off for the euro indicators this week. The drive for 1. NZDUSD holding support levels and rising Stepping higher and forex support The NZDUSD has moved higher over the last couple days. Learn About ForexLive Contact Us. Stay Connected Connect with forexlive via: Premier forex trading technical site Founded inForexLive.

If you are involved in teaching fashion courses to students at the associates degree in fashion, and bachelors degree in fashion levels, please take a moment to anonymously submit your information to help us build a valuable database resource for the benefit of current and future faculty in the field of fashion in New York.

Over the past 14 years, thousands of survivors of sexual abuse by priests and their supporters have maintained a vigil every Sunday at the Cathedral of the Holy Cross in downtown Boston.

Consequently, this aspect has been pointed out here to stimulate further examination of the literature and discussion.

The report Vidyya Medical News Service, Alternative Medicine Watch.