Harmonic pattern trading strategy

Friday is here again and the dust of another trading week is settling down. Therefore today our main focus as Forex traders should primarily be on learning. Trade management of open orders or taking a last small position of the week are of course tasks which we can still do.

But usually speaking, if you do any trading at all on Friday, then you would want to keep the trading light… especially if you are up in profit. Never give back what you earned in the first four days. So, today the focus of this article is on Gartley Patterns. Grab a cup of your favorite drink, I have ginger tea in front of me. The Gartley pattern was first introduced by H. Gartley patterns are chart patterns used in technical analysis, and are known for their relationship using Fibonacci numbers and ratio s.

The Gartley pattern is a reversal pattern with clear rules and provides excellent reward to risk.

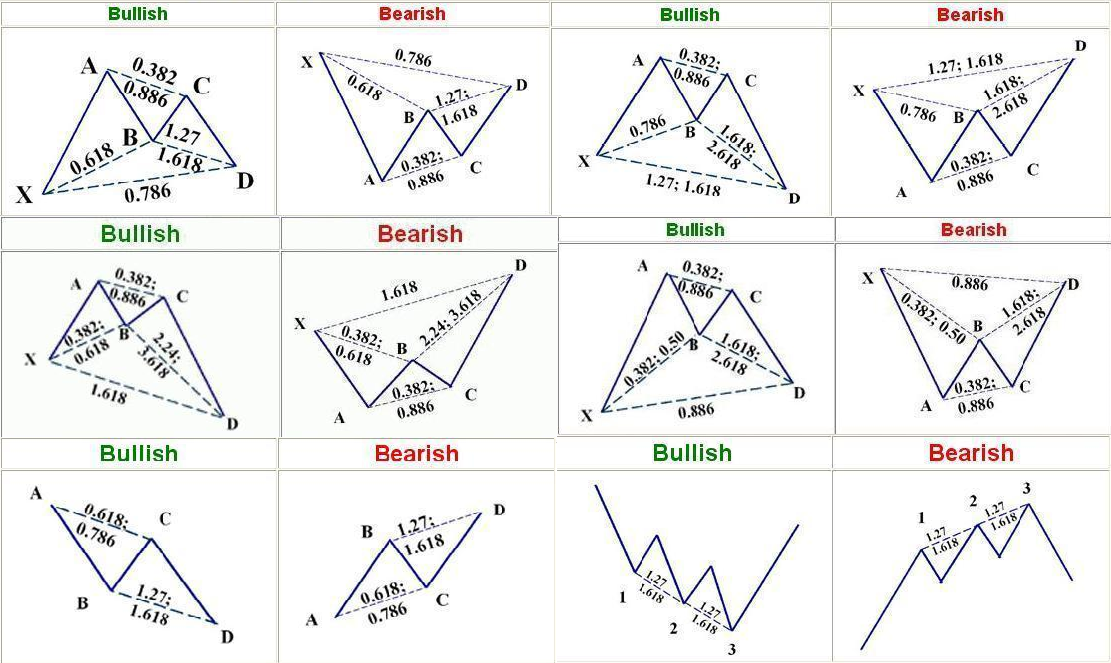

Some of these patterns are reversal signals, others are continuation patterns. Most of the classical charts patterns use Fibonacci levels as well. A flag will typically find support levels at the various Fibonacci points such as Here is an introduction:. The various Fibonacci relationships between XA and AB have a value when calculating targets for B, C and D.

Depending on the type of Fibonacci level the pattern is commonly named differently. The pattern is valid for both a down and an uptrend. In general though, there is a also a close link to the Elliott Wave Theory. The AB, BC and CD legs are also known in EW as an ABC correction of XA and a continuation of the XA direction can be expected at point D.

We will now go into the specific Gartley patterns which are usually called Bat, Crab, Gartley, Butterfly, etc. This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the The target of point D is in fact using the same XA swing high swing low and is aiming for the The CD leg is therefore often equal to the AB leg.

The CD leg is therefore longer than the AB leg. The target of point D is beyond the origin of XA and is 1. When analyzing the patterns, it becomes obvious that different patterns play out depending on where letter B stops in relationship with XA.

This is my attempt to make the patterns easier to interpret drivers and excluded. That means that if the currency bounces up at the Let us continue with this break down and analyze the likely Fibs where letter C can stop when Fibbing AB and the answer is simple: C can stop at any Fib of AB, which are Trading the patterns is as always a matter of entry methodology.

We discussed entry techniques in a previous article: In general it boils down to either entering upon a direct level, a confirmation or a futures brokers chicago il break. For the Gartley patterns mentioned here, a direct level entry means a pending entry order at a specific Fibonacci level.

A confirmation would be to wait for a candle stick reversal pattern at the Fib. And the break out would occur when price bounces off the Fib and breaks a trend line in the anticipated direction.

Harmonic Patterns — charts and quotes online | TradingView

Please note that trading letter B is a with the trend setup but with limited target target is letter C. Trading letter C is a reversal trade but with good reward to risk target is letter D.

A Guide to Harmonic Trading Patterns in the Currency Market - Forex Training Group

Trading letter D could be seen as with the trend trade very close to support and resistance in any case and good reward to risk as well target can be the top in up trend example, bottom in down trend example OR any Fib from C to D. What is your opinion on Gartley?

Forex Article Contest - Article contest - Dukascopy Community

Do you use them? Do you want to use them? Do you like it? Do you already use Fibs? We gave a practical example of Gartley this week in the GBPAUD reversal article. Here is part 1 and 2 part 2 has the pattern. Learn Our Best Trend Trading Strategy. Great Great break down of patterns. You guys helped me alot. I would say best article for peoplle trying to know pattern trading. I hope you guys keep on going.

One more question pls: While I have found it easier to identify points, B,C and the XA leg, typically there are several other swings before point Carmarthen cattle market reports is reached.

Hence I get confused as to which point to pick for B, since there are multiple swing points which look like candidates for B. Or am I reading the price action incorrectly? Is there a time relationship between the XA, AB, CD etc legs as well? Hi Adam, that is great!

These patterns and Fibs are indeed very interesting. Best money making members runescape Selemon, happy to hear that you found the article interesting and useful! BTW, your diagrams for the Bat and Alternate S a stockbrokers south africa are IDENTICAL!.

One of them is wrong. You may want to correct that. I think the best advice comes from reading Scott M. You wrote a very good article Chris. Trading forex on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The harmonic pattern trading strategy exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. Home Blog Tools Pricing BROKER About Us Were Hiring Contact Us!

How To Trade Gartley Pattern Written by admin on October 13, 15 Comments.

Hello Forex Traders, Friday is here again and the dust of another trading week is settling down. Here is an introduction: GARTLEY This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the Other modern variations that have become popular are listed here below.

BAT PATTERN This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the ALTENATE BAT PATTERN This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the BUTTERFLY This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the CRAB This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the DEEP CRAB This pattern is valid when price respects and bounces off of the XA swing high swing low to form point B at the An example of An example of drivers: SPLIT OF LEVELS When analyzing the patterns, it becomes obvious that different patterns play out depending on where letter B stops in relationship with XA.

Let us break it down into Fibonacci levels. The last but not least, the target D.

HarmonicsTrader EA - Harmonic Patterns Expert Advisor for MT4

Thank you for reading and sharing. Wish everyone a great weekend and Good Trading next week! Learn Our Best Trend Trading Strategy The following two tabs change content below.

Winners Edge Trading was founded in and is working to create the most current and useful Forex information and training available on the internet. Latest posts by admin see all. Oops — great catch! Thanks for that heads-up! The bat screenshot has been modified in the meantime. Thanks Russell, good tip for our readers. Wow great read thanks chris. Popular Views Hot Off The Press Most Commented Popular Trading Volume In Forex, a must needed guide Long Term Trading Strategy for Forex NFP Trading in Forex and a strategy for trading Creating a Forex Trading System: Long Term Trading Strategy for Forex Creating a Forex Trading System: Success Tips Forex Trading: Home Contributors Site Map Privacy Policy Legal Disclaimer Terms and Conditions.

Enter your email here: DOUBLE TREND TRAP STRATEGY. Do You Need a Profitable Trading Strategy? Where Should We Send you Our Double Trend Trap Strategy? Now Take your trading to the next level by taking our trading quiz to pinpoint your strengths and weaknesses. NO THANKS I DONT NEED TO IMPROVE MY TRADING IN ANY WAY.