What is an eft in the stock market

Investing in stocks and bonds has become easier and easier over the years. First, there were mutual funds, then index funds.

What is an EFT in the stock markets? | Yahoo Answers

Now, exchange-traded funds are all the rage. In fact, you could do all your investing with the 1, or so ETFs, most of which use index-style strategies rather than active management. It's very easy, taking just a few clicks of a mouse with your online-broker—just like trading a stock. Fees are extraordinarily low, and ETFs can be very kind come tax time. Like mutual funds, ETFs pool investor assets and buy stocks or bonds according to a basic strategy spelled out when the ETF is created.

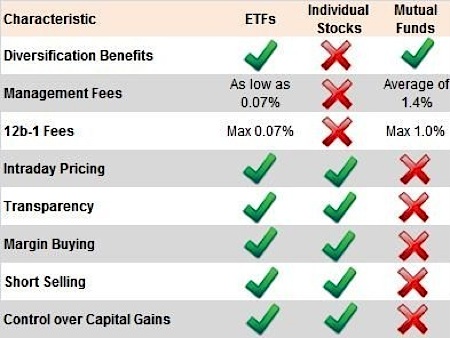

But ETFs trade just like stocks, and you can buy or sell anytime during the trading day. Mutual funds are bought or sold at the end of the day, at the price, or net asset value NAV , determined by the closing prices of the stocks or bonds owned by the fund. Because they trade like stocks, ETFs can be sold short, a way of profiting if the ETF price drops instead of rises. And many ETFs have related options contracts, which allow investors to control large numbers of shares with less money than if they owned the shares outright.

Short selling and options are not available with mutual funds.

This difference makes ETFs better for day-traders betting on short-term price changes of entire market sectors. For long-term investors, these features don't matter. Most ETFs are index-style investments, similar to index mutual funds. Investors therefore know what securities their fund holds, and they enjoy returns matching those of the underlying index. Many investors like index products because they are not dependent on the talents of a fund manager who might lose his touch, retire or quit.

Exchange-traded fund - Wikipedia

Gen Y Has to Start Investing Now. While the vast majority of ETFs are index investments, mutual funds come in both flavors, indexed and actively managed, which employ analysts and managers to hunt for stocks or bonds that will generate alpha—return in excess of a standard performance benchmark.

So investors really face two issues: Should they choose actively managed funds over indexed products? If they prefer indexed ones, are ETFs preferable to mutual funds?

Many studies have shown that over time, most active managers fail to beat their comparable index funds and ETFs, because picking market-beating investments is very hard.

Also, managed funds must charge larger fees, or "expense ratios," to pay for all that work. Many managed funds have annual charges as high as 1.

In contrast, the Vanguard Index Fund VFINX , a mutual fund, charges just 0. Francis, an advisor with Portland Fixed Income Specialists in Beaverton, Ore. Active management is worth paying for only if returns which account for the fees beat those of the comparable index products.

And the investor must be convinced the active manager won through skill, not luck. Not just over one year, but three, five, 10 years? In looking at that track record, be sure the long-term average has not been skewed by just one or two extraordinary years, as spikes are often due to sheer luck, cautioned Stephen Craffen, a partner with Stonegate Wealth Management in Fair Lawn, NJ.

Some financial advisors believe that active management can beat indexing in fringe markets, where a small amount of trading and a shortage of analysts and investors can leave bargains undiscovered. Others favor active management for high-yield bonds, foreign stocks or small-company stocks. Cordaro, an advisor with RegentAtlantic of Morristown, N.

Many experts therefore suggest that index investments make up the core of the small investor's portfolio, since the core is typically invested in widely traded, well-known securities. Indexed products are especially good in taxable accounts because their buy-and-hold style means they don't sell many of their money making holdings. That keeps annual "capital gains distributions"—a payout to investors late in the year—at an absolute minimum. Actively managed funds, because they do lots of selling in the pursuit of the "latest, greatest" stock holdings, can have large payouts, which produce annual capital gains taxes.

In the past few years, ETFs have moved into some very narrowly defined markets focused on very small stocks, foreign stocks and foreign bonds. While advocates think bargains can be found in esoteric markets, ETFs in thinly traded markets can be subject to problems like "tracking error," when the ETF price does not accurately reflect the value of the assets it owns, said George Kiraly, an advisor with LodeStar Advisory Group in Short Hills, N.

Therefore, if you see worrisome discrepancies between an ETF's net asset value and price, maybe you should look for a comparable index mutual fund. This data is available on fund tracker Morningstar's ETF pages. The biggest issue in the ETF versus traditional mutual fund battle is the broker's commission you pay with every purchase and sale. Many actively managed mutual funds carry "loads," which are upfront sales commissions, often 3 percent to 5 percent of the investment.

With a 5 percent load, the fund would need a significant gain before the investor could sell for enough to break even. ETFs, however, can also rack up fees when used with certain investing strategies. You'd also pay commissions when you made withdrawals in retirement, though you could minimize that by taking out more money on fewer occasions. ETF fees do tend to be lower. And although index mutual funds have small annual distributions and low taxes, comparable ETFs sometimes have even smaller distributions.

So, for investing a large sum in one block, an ETF may be the cheaper choice. For piecemeal investing every month, the index mutual fund could be the better option. Asia Europe Stocks Commodities Currencies Bonds Funds ETFs Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Make It Entrepreneurs Leadership Careers Money Specials Shows Video Top Video Latest Video U.

Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes Shows Watch Live CNBC U. Business Day CNBC U. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Full Episodes. Log In Register Log Out News Economy Finance Health Care Real Estate Wealth Autos Consumer Earnings Energy Life Media Politics Retail Commentary Special Reports Asia Europe CFO Council.

Strategic Beta & Active ETFs - Franklin LibertyShares™ ETFs

Asia Europe Stocks Commodities Currencies Bonds Funds ETFs. Make It Entrepreneurs Leadership Careers Money Specials Shows Investing Trading Nation Trader Talk Financial Advisors Personal Finance Etf Street Portfolio Watchlist Stock Screener Fund Screener.

Tech Mobile Social Media Enterprise Gaming Cybersecurity Tech Guide Video Top Video Latest Video U. Video Asia Video Europe Video CEO Interviews Analyst Interviews Full Episodes. Primetime CNBC Asia-Pacific CNBC Europe CNBC World Special Reports Top States Paris Airshow Trailblazers Trading the World CNBC Disruptor 50 Lasting Legacy Modern Medicine College Game Plan Investing in: Israel Tech Drivers The Brave Ones Trading Nation Shaping the future Future Opportunities.

Register Log In Profile Email Preferences PRO Sign Out. Here's What You Should Know Jeff Brown, Special to CNBC. So why not buy a few ETFs and let it go at that?