Forex lot size calculator formula

You, the newbie, must know certain terms like the back of your hand before making your first trade. The base currency is the first currency in any currency pair. The currency quote shows how much the base currency is worth as measured against the second currency.

In the forex market, the U.

The primary exceptions to this rule are the British pound, the euro, and the Australian and New Zealand dollar. The quote currency is the second currency in any currency pair. This is frequently called the pip currency and any unrealized profit or loss is expressed in this currency. In this instance, a single pip equals the smallest change in the fourth decimal place — that is, 0.

One-tenth of a pip. Some brokers quote fractional pips, or pipettes, for added precision in quoting rates. The bid is the price at which the market is prepared to buy a specific currency pair in the forex market. At this price, the trader can sell the base currency.

It is shown on the left side of the quotation.

This means you sell one British pound for 1. At this price, you can buy the base currency.

It is shown on the right side of the quotation. This means you can buy one euro for 1. The ask price is also known as the offer trading strategies involving options(spread and combination). The spread is the difference between the bid and ask price.

Trading Calculator | Forex | FxPro Help Centre

These digits forex lot size calculator formula often omitted in dealer quotes. Round-turn means a buy or sell trade and an offsetting sell or buy trade of the same size in the same currency pair.

A cross currency is any pair in which neither currency is the U. These pairs exhibit erratic price behavior since the trader has, in effect, initiated two Forex lot size calculator formula trades. Cross currency pairs frequently carry a higher transaction cost. When you open a new margin account with a forex broker, you must deposit a minimum amount with that broker.

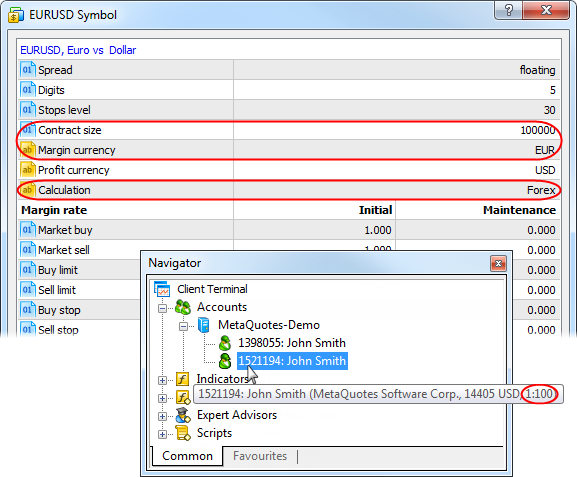

Each time you execute a new trade, a certain percentage of the account balance in buy sirius mining shares margin account will be set aside as the initial margin requirement for the new trade. The amount is based upon the underlying currency pair, its current price, and the number of units or lots traded. The lot size always refers to the base currency.

Mini accounts trade mini lots. Leverage is the ratio of the amount capital used in a transaction to the required security deposit margin. It is the ability to control large dollar amounts of a security with a relatively small amount of capital.

Leveraging varies dramatically with different brokers, ranging from 2: We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders.

We're also a community of traders that support each other on our daily trading journey.

Lot sizing your Forex trading deals using MetaTrader4 🌟🌟🌟🌟🌟BabyPips The beginner's guide to FX trading News Trading. How to Trade Forex Trading Quizzes Forex Glossary.

School of Pipsology Preschool How Do You Trade Forex? Impress Your Date with Forex Lingo. Partner Center Find a Broker.

Position Size Calculator, Forex Position Size Calculator

Types of Forex Orders. When Can You Trade Forex? How Do You Trade Forex? Simplicity is the ultimate sophistication. Privacy Policy Risk Disclosure Terms of Use.