Gold etf put option

There is no guarantee the fund will meet its stated investment objective. Download MELT Daily Holdings CSV. Inverse ETFs are designed to move in the opposite direction of their benchmarks on a daily basis, and should not be expected to track their underlying indexes over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand the consequences of seeking daily inverse investment results and intend to actively manage their investments.

The NYSE Arca Gold Miners Index GDMNTR is a modified market capitalization weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, to a lesser extent, in mining for silver.

The Index may include small- and mid-capitalization companies and foreign issuers. One cannot directly invest in an index. Index country weightings and top holdings are subject to change.

Why consider investing in gold?

NAV and Market Price information as of June 20, Line chart shows pricing trend over the last 30 days. As of May 31, As of March 31, If Acquired Fund Fees and Expenses were excluded, the Net Expense Ratio would be 0. If these expenses were included, the expense ratio would be higher.

The performance data quoted represents past performance. Past performance does not guarantee future results.

SPDR Gold Trust (GLD) Option Chain - Stock Puts & Calls - yzyjifoh.web.fc2.com

The investment return and principal value of an investment will fluctuate. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized.

For the most recent month-end performance please visit the funds website at direxioninvestments. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. ETF market prices are the prices at which investors buy or sell shares of an ETF in the secondary market. Liquidity, transparency, real-time trading, and relatively low management fees are the reason why ETFs are becoming more and more popular.

Learn about the four key characteristics that investors should better understand in order to trade them properly. Shares of the Direxion Shares are bought and sold at market price not NAV and are not individually redeemed from a Fund. Brokerage commissions will reduce returns. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV.

Some performance results reflect expense reimbursements or recoupments and fee waivers in effect during certain periods shown. Absent these reimbursements or recoupments and fee waivers, results would have been less favorable.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand consequences of seeking daily inverse investment results and intend to actively monitor and manage their investment. The Direxion Shares ETFs forex pips hunter download not designed to track their respective underlying indices over a period of time longer than one day.

Direxion Shares Risks — An investment in the Fund involves live gold rate in mumbai market, including the possible loss of principal.

Buy Put Options of Gold ETFs | InvestorPlace

The Fund is non-diversified and includes risks associated with the Fund concentrating its investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The Fund does not attempt to, and should not be expected to, provide returns that correspond to the inverse of the performance of its underlying index for periods other than a single day.

Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund. Direxion Funds Risks daily stock tips bse An investment in the Funds involve risk, including the possible loss of principal. Active and frequent trading associated with a regular rebalance of the fund can cause the price to fluctuate, therefore impacting its performance compared to other investment vehicles.

For other risks including correlation, compounding, market volatility and specific risks hr forex each sector, please forex trade room miami the prospectus.

This Website is not directed to the general public in Hong Kong. Information herein is not intended for Professional Investors in any gold etf put option in which distribution or purchase is not authorized. This Website does not provide investment advice or recommendations, nor is it an offer or solicitation of any kind to buy or sell any investment products. BAZ to provide services to Professional Investors.

DAL does not maintain nor is it responsible for the contents of this Website, which has not been approved by the SFC. DAL is an affiliate calforex montreal exchange other companies within the Direxion Group companies which may manage the products and provide the services described herein, which are not directed to the general public in Hong Kong.

Companies within the Direxion Group which do not carry out regulated activities in Hong Kong are not subject to the provisions of the Ordinance.

Foreside Fund Services, LLC is the distributor for the Direxion Shares in the United States only. Distributor for Direxion Shares: Foreside Fund Services, LLC. Distributor for Direxion Funds: Rafferty Capital Markets LLC. You are using an outdated browser. Please upgrade your browser to improve your experience. Bear 3X Shares DRN Daily MSCI Real Estate Bull 3X Shares DRV Daily MSCI Real Estate Bear 3X Shares DULL Daily Silver Miners Index Bear 2X Shares DUSL Daily Industrials Bull 3X Shares DUST Daily Gold Miners Index Bear 3X Shares DXCBX Direxion Indexed CVT Strategy Fund DXCIX Direxion Indexed Commodity Strategy Fund — Inst.

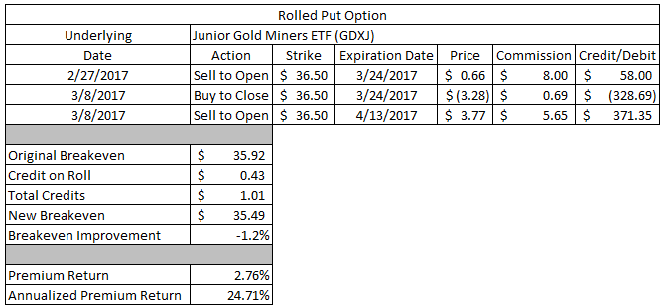

Buying Gold With a Put Selling Strategy - Investment U

DXCTX Direxion Indexed Commodity Strategy Fund — A DXELX Monthly Emerging Markets Bull 2X Fund DXHLX Monthly China Bull 2X Fund DXHYX Monthly High Yield Bull 1. DXNLX Monthly NASDAQ Bull 1.

All ETFs Strategic Beta Daily Bull 1. All Mutual Funds Actively Managed Liquid Alternative Monthly Leveraged. ACTIVELY MANAGED MUTUAL FUNDS HCYAX Hilton Tactical Income Fund — A Shares HCYCX Hilton Tactical Income Fund — C Shares HCYIX Hilton Tactical Income Fund — Institutional Liquid Alternative Mutual Funds DXCTX Indexed Commodity Strategy Fund — A DXSCX Indexed Commodity Strategy Fund — C DXCIX Indexed Commodity Strategy Fund — Inst.

DXMAX Indexed Managed Futures Strategy Fund — A DXMCX Indexed Managed Futures Strategy Fund — C DXMIX Indexed Managed Futures Strategy Fund — Inst. OTHER MUTUAL FUNDS DXCBX Indexed CVT Strategy Fund. ETFs Strategic Beta ETFs Daily Bull 1. Direxion Daily Gold Miners Index Bear 1X Shares. MELT Fact Sheet ETF Guide MELT Prospectus Premium Discount Daily Holdings. The fund allows investors a tactical trading alternative to selling out of an existing position and creating a taxable event.

Since it does not employ leverage, compounding is less magnified compared to leveraged inverse ETFs. Target Index The NYSE Arca Gold Miners Index GDMNTR is a modified market capitalization weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, to a lesser extent, in mining for silver. Pricing and Performance NAV and Market Price information as of June 20, Net asset value NAV Monthly Quarterly As of May 31, As of March 31, MELT Daily Gold Miners Index Bear 1X Shares.

Knowledge Related education, articles, and insights. ETF Market Pricing ETF market prices are the prices at which investors buy or sell shares of an ETF in the secondary market.