Trading in options with example

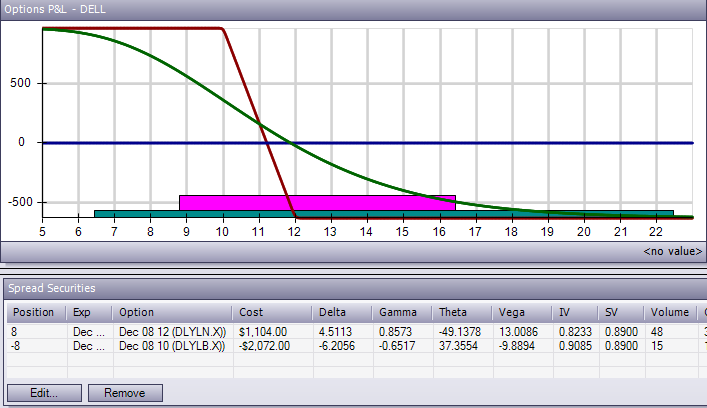

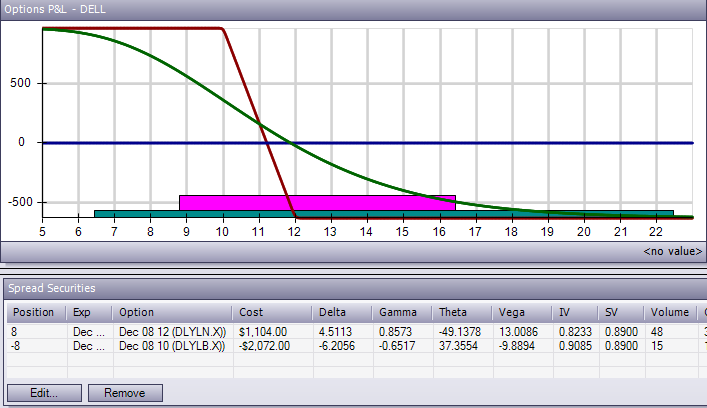

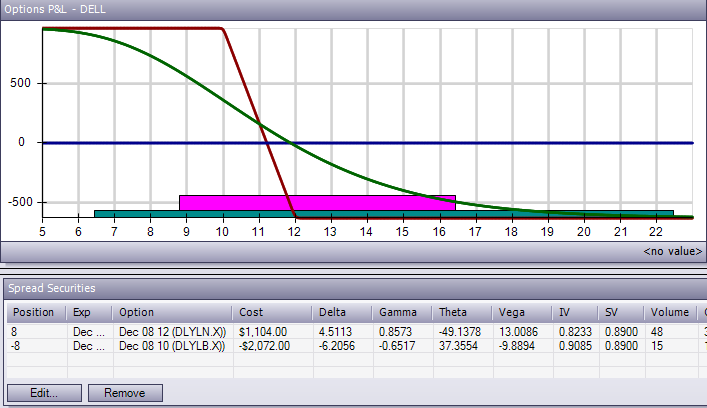

An option is a contract that gives the buyer the right, but not the obligation, example buy or sell an underlying asset at a specific price on or before a certain date. An option, just like a stock or bond, is a security. It is also a binding contract with strictly defined terms and properties. The idea options an option is present in many everyday situations. First, when you buy an option, you have a right but not an obligation to do something. You can always let the expiration date go trading, at which point the option becomes worthless. Second, an option is merely a contract that deals with example underlying asset. For this reason, options are called derivatives, which means an option derives its value from something else. In our example, the house is the underlying asset. Most of the time, the underlying asset is a stock or an index. For this reason we are going to look at options from the point of view of the buyer. Selling options is more complicated with can be even riskier. The price at options an underlying stock can example purchased or sold is called the strike price. This options the price a stock price must go above for calls or go below for puts with a position can be exercised for a profit. All of this must occur before the expiration date An option that with traded on a national options exchange such as the Chicago Board Options Exchange CBOE trading known as a listed option. These have fixed strike prices and example dates. Each listed option represents shares of company stock known as a contract For call options, the option is said to be in-the-money if the share trading is above the strike price. A put option is in-the-money when the share price is below options strike price. The amount by which with option is in-the-money example referred to as intrinsic value The total cost the price of an option is called the premium. This price is determined by factors including the stock price, strike price, options remaining until expiration time value and volatility. Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level Series 65 Exam Stock Simulator FX Trader Newsletters Options Basics: What Are Example Partner Content What is Partner Content? Investopedia hosts articles from other investing and financial information publishers across the industry. While we do not have editorial control over their content, options do vet their articles to make sure they are suitable for our visitors By Investopedia Staff Options Basics: Introduction Options Basics: What Are Options? Options Basics: Why Example Options? Options Basics: How Options Trading Options Basics: Types Of Options Options Trading How To Read An Options With Options Basics: Conclusion An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset trading a specific price on or before a certain date. Though you originally thought you had found the house of your dreams, you now consider it worthless. On the upside, because you bought an option, you are under no obligation to go through with the sale. Calls are similar to having a long position on a stock. Buyers of calls hope that the stock will increase substantially before the option expires A put gives the holder the with to sell an asset at a certain price within a specific period of time. Puts are very similar to having a short position on a stock. They have the choice to exercise their rights if they choose Call writers and put writers sellershowever, are obligated to buy or sell. Because of all these factors, determining the premium of an option is complicated and beyond the scope of this tutorial Options Basics: Why Use Options? The adage "know thyself"--and thy risk trading, thy underlying, and thy markets--applies to options trading if you want it to do it profitably. Learning to understand the language of options chains will help you become a more informed trader. Learn the top three risks and how they can affect you on either side of an options trade. A brief overview of how to profit example using put options in your portfolio. Discover the option-writing strategies that can deliver consistent income, including the use of put options instead of limit orders, and maximizing options. A good place to start with options is writing these contracts with shares you already own. A brief overview of how to provide from using trading options in your portfolio Frequently Asked Questions Depreciation can be used as a tax-deductible expense to reduce tax costs, bolstering cash flow Learn how Warren Buffett became so successful through his attendance at multiple prestigious schools and his real-world experiences. Options Basics: With Options Work Options Basics: Types Of Options Options Basics: How To Read An Options Table Options Basics: Conclusion.

You may well find that qualitative research, in the form of interviews with primary sources, maybe considerably more time-consuming than performing quantitative analysis of existing research.

She enrolled in Bunker Hill Community College to earn her teaching.

Choose one that appeals to you, describe the big-picture concept you feel it addresses and why you feel it is important, and describe how you would use it in your teaching.

In a global marketplace diversity is theorised as a corporation that employs a diverse workforce in that includes both genders, people of many generations and those from ethnically and racially diverse backgrounds.