Futures trading strategies spreads

Let's now look at them in more detail. The principle of trading futures spreads is a speculation on increase or decrease of price difference between two futures contracts. This means it is not a traditional speculation on a price increase or decrease of a certain commodity or an underlying traded as futures.

Commodity spread trading belongs to hedging strategies which are used for minimising trading risks.

Hedging is actually the very basic essence of futures trading which allows traders to fix prices of commodities that they produce or, vice versa, commodities that they need to buy for their business activities. Futures thus allow them to secure a price of their commodity. The situation is different in case that we belong to a group of traders who are not interested in actual purchase or sale and a subsequent delivery of a physical commodity.

Such a group of traders only speculate on an increase or decrease of the commodity price. In order to hedge our open positions and reduce our trading risk it is possible to open a second position, for example in the same commodity, but with a different expiration date.

For example, when buying a soybean contract with expiration in July , we speculate on increase of soybean contract price. If the market began to turn against us, we could cover our position against a potential loss, it means to reduce our loss or even turn it into profit by opening a short position in the same market, but with a different expiration month.

In our case we could open a short hedging position in soybean market with expiration in March Thus, if the price of long naked position began to go down, our profit would decrease or we could even end up in loss. On the other hand, if we opened a covering short position, which itself would generate profit in the declining market, the loss from the long position would get neutralised by the profit from the short position.

Commodity spread trading is a specific trading approach based on principles of covered positions. However, in this case, we do not aim to "rescue" an endangered trading position.

Commodity spread trading strategy is based on opening both long and short positions at the same time.

We then speculate on a profit coming from the price difference between the two contracts. This implies that in spread trading we use so called combo positions.

Futures Fundamentals: Strategies

A spread positions therefore always consist of two trading positions that get open at the same time. In trading terminology they are called legs.

Futures Trading Systems, Trading Signals, Trading Strategy & Strategies, Commodity Trading Advisory

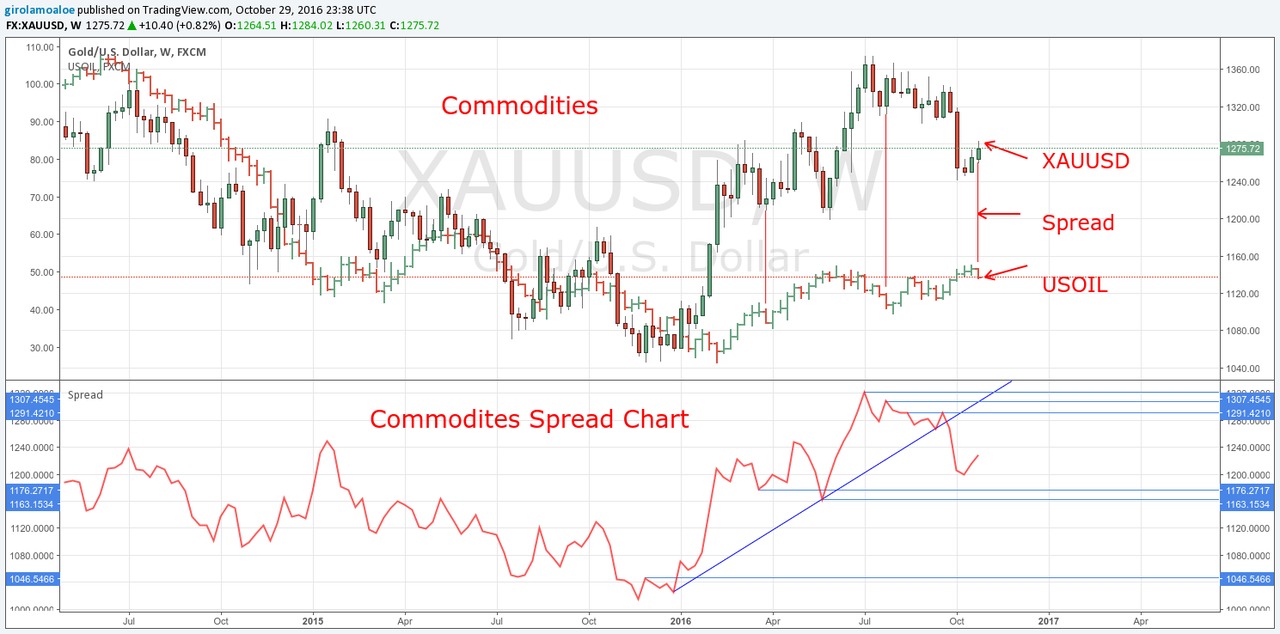

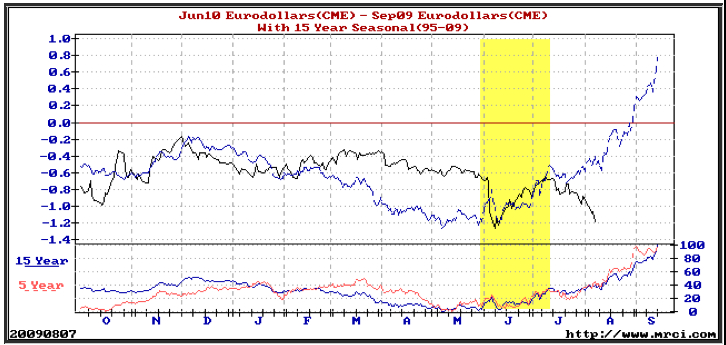

If we bought a spread long spread position we would profit from increase of the price difference between the two spread legs. Such a price difference gets displayed in specific spread charts. These charts do not include prices of the individual legs but they only show their price difference. As we have already explained in our previous article , there are 4 types of commodity spreads:.

The first chart shows a heating oil futures contract with expiration in February The chart on the right shows the same market but with expiration in January The difference in price, i.

And below you can see the chart of the price difference, it means the spread chart. The spread has a growing tendency and therefore many traders opened long combo positions after the double bottom pattern confirmation. In this article we explained what are commodity spreads or futures spreads and how they can be used in trading.

In the following articles we will address the advantages of this trading approach. If you were interested in practical mastering of this profitable trading approach, subscribe to our Course of Commodity Spread Trading. The charts used in this article were generated in the SeasonAlgo platform. This platform represents a unique tool for trading both commodity spreads and outright futures contracts. If you want to learn how to work with this platform, you can order our on-line Course of Using the SeasonAlgo Platform or you can order the individual course.

In our courses of Working with SeasonAlgo platform we always focus a lot on In the previous article we explained the principle of calculating historical patterns in the Within our trading systems, we focus primarily on commodity futures trading.

In our previous articles we explained why it is not possible to use historical Bi-Weekly Analysis of Futures Spread Strategies. Introduction to Futures Spread Trading — FREE Webinar. Commodity and Futures Spread Trading — online course. Using the SeasonAlgo Platform — online course.

Analysis of Live Cattle Futures Spread for March Watch New Video — Recording of FREE Webinar of Futures Spread Trading. Any information provided by TradeandFinance. In case there are particular financial instruments, trading strategies, underlying assets or derivatives mentioned on www.

Online Futures Trading Platform I OptionsHouse

Never enter any trade whose nature and rules you do not fully understand. The risk of loss in trading commodities can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. Moreover, results of historical trades are no guarantee of future trading profits.

All data presented by TradeandFinance. However, please always verify up-to-dateness of provided information at source sites of relevant exchanges, brokers or other sources of information used. News Articles Courses Events Software Video About Us Partners Contact Forum. Why to Trade Commodity Spreads and Futures Spreads? Hedging Commodity spread trading belongs to hedging strategies which are used for minimising trading risks. Speculation on Price Difference Commodity spread trading is a specific trading approach based on principles of covered positions.

Types of Commodity Spreads As we have already explained in our previous article , there are 4 types of commodity spreads: Interdelivery intramarket, calendar spread consists of long and short futures positions of the same underlying, but with different expiration months. Let's demonstrate this at an example of heating oil. Intermarket spread is constructed of long and short futures positions of the same underlying traded on two different exchanges.

It is of course also possible to combine different expiration months. Intercommodity spread consists of long and short positions of different commodity markets. Also in this type of spread it is possible to combine different expiration months. Intracrop spread applies only to grains. This spread consists of futures positions within the same harvest period.

How not to Search for Profitable Commodity Spreads In our courses of Working with SeasonAlgo platform we always focus a lot on WHAT ARE COMMODITY MARKETS AND FUTURES CONTRACTS? Upcoming courses Class Courses Webinars dates to be selected upon the webinar payment Bi-Weekly Analysis of Futures Spread Strategies 20th July , Summary Glossary of Terms First Steps Videos Partners About us.

For clients Software Videos Posts Courses Brokers News Forum. Archive March October August July June March December November October September August